This Black Friday and Cyber Monday, the biggest battle wasn't just the best deals; it was visibility in AI Search. As millions of shoppers turned to Answer Engines like ChatGPT, Perplexity, and Google AI Overviews to find the best deals, one question mattered most: which brands and products did AI recommend?

We launched a Black Friday Index, the first public benchmark tracking which brands and products dominate AI Shopping answers during the critical Black Friday and Cyber Monday holiday shopping marathon of November 25 to December 1, 2025.

Built on over 400 million real conversations, the Black Friday Index reveals clear winners, surprising upsets, and what it takes to succeed as AI reshapes retail.

How the Black Friday Index works

It starts with real user prompts from Prompt Volumes to identify the retail categories with high Black Friday search volume. For each category, we generated 50 unbranded Black Friday related prompts. Half reflect broad shopping intent, such as “Where do I get the best Black Friday deals on laptops?” and half include price or feature constraints, like “Where do I get Black Friday deals on laptops under 500 dollars?”

We extracted brand and product visibility from ChatGPT's answers, scoring each brand based on how frequently it appeared across prompts. Brand rankings are powered by Answer Engine Insights, while product rankings use data from Profound Shopping.

The winners' circle: big names, bigger deltas

Anna Hensel, executive editor at Modern Retail, covered our Black Friday Index in a recent piece showcasing how Ulta, Best Buy, and Adidas emerged as the top three most consistently visible brands across categories. But even among leaders, the spread in visibility scores revealed just how uneven the AI recommendation landscape truly is.

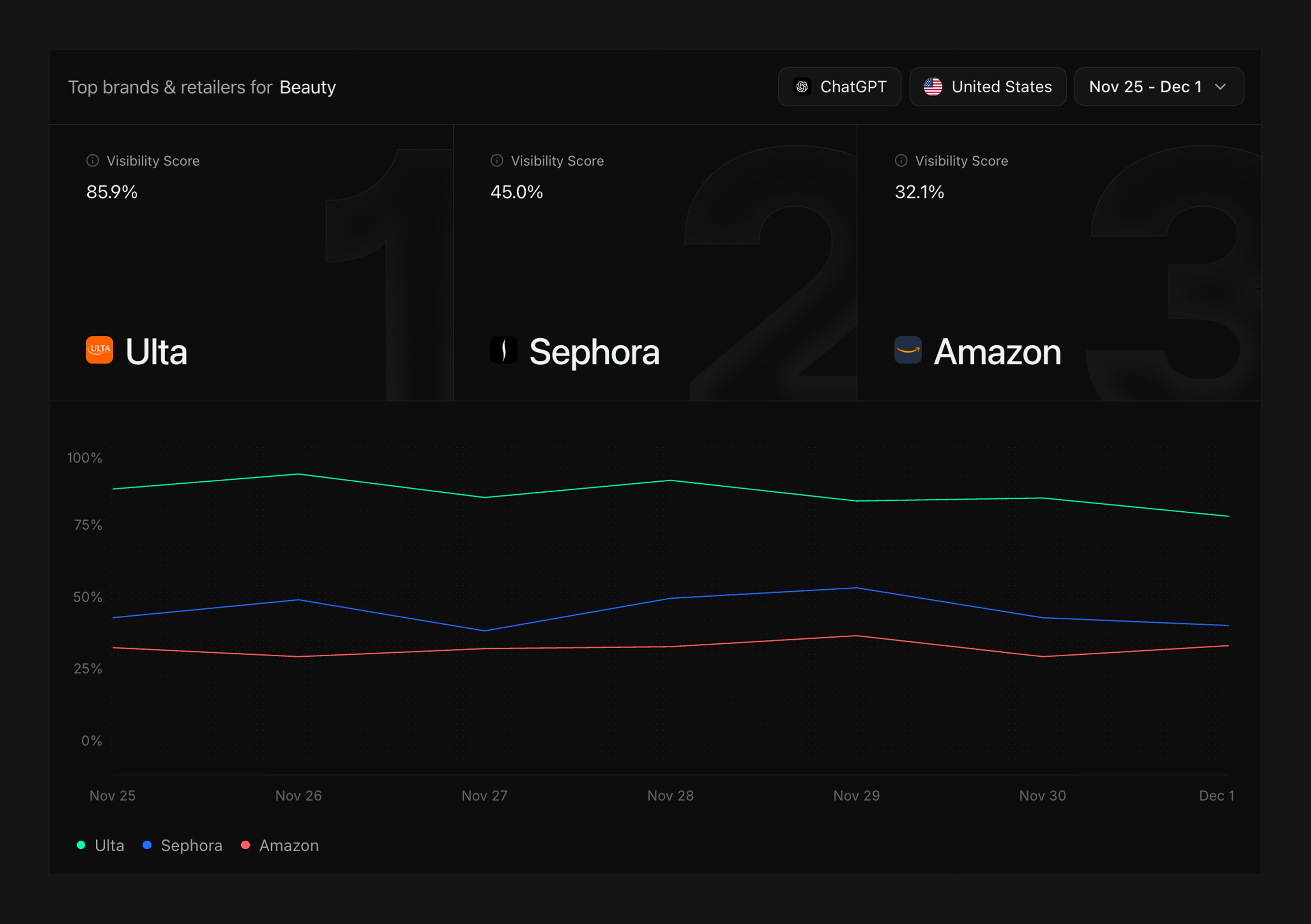

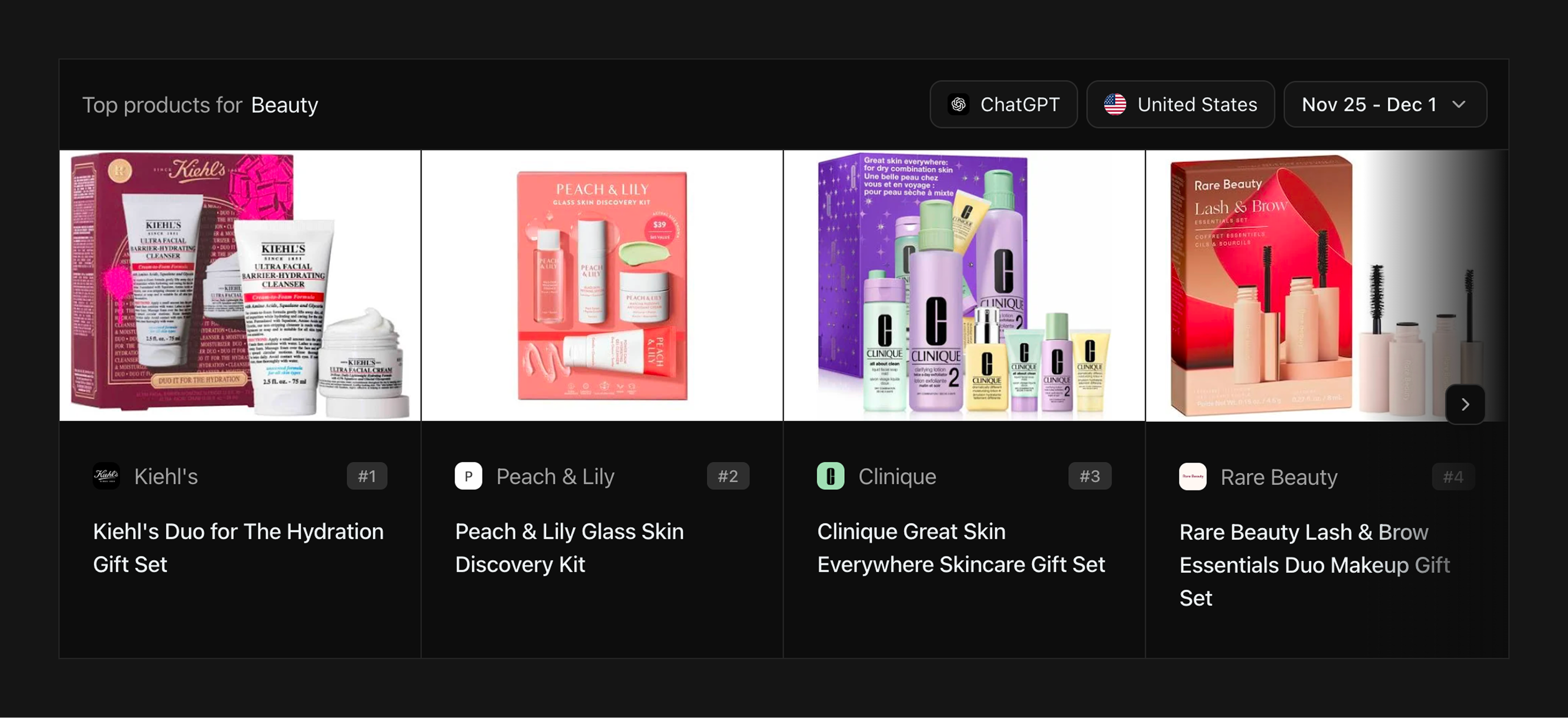

Beauty: Ulta's commanding lead

In the beauty category, Ulta achieved an 85.9% visibility score, appearing in the vast majority of relevant conversations. Sephora, its closest competitor, appeared in just 45% of answers. That's nearly double the gap.

Ulta's early and comprehensive content strategy around Black Friday, including product pages with clear deal messaging, strong metadata, and timely indexed content that answered the exact questions shoppers were asking.

Appliances and electronics: the big box advantage

Large retailers with broad assortments dominated these categories. In appliances, Walmart (74.1%), Best Buy (69.3%), and Home Depot (50.3%) were the top three most visible brands. This category showed higher brand consolidation than others, suggesting utility-focused purchases are still heavily influenced by storewide discounting and merchant trust.

In electronics, Best Buy and Amazon led visibility, though Amazon's presence came with a notable twist. Despite blocking ChatGPT from scraping its product catalog, Amazon still appeared frequently as a recommended merchant. ChatGPT surfaced Amazon as a trusted place to shop, even if it couldn't reference specific Amazon items. This creates a significant opportunity for other brands to have their products recommended instead.

Surprises in wearables and shoes

Apple, typically dominant in wearables, lagged behind. Meanwhile, Garmin showed unexpectedly strong visibility. The difference: deep, structured content on Garmin's product pages, including FAQs, comparison tables, and price-specific callouts that aligned closely with how people asked questions during Cyber Week.

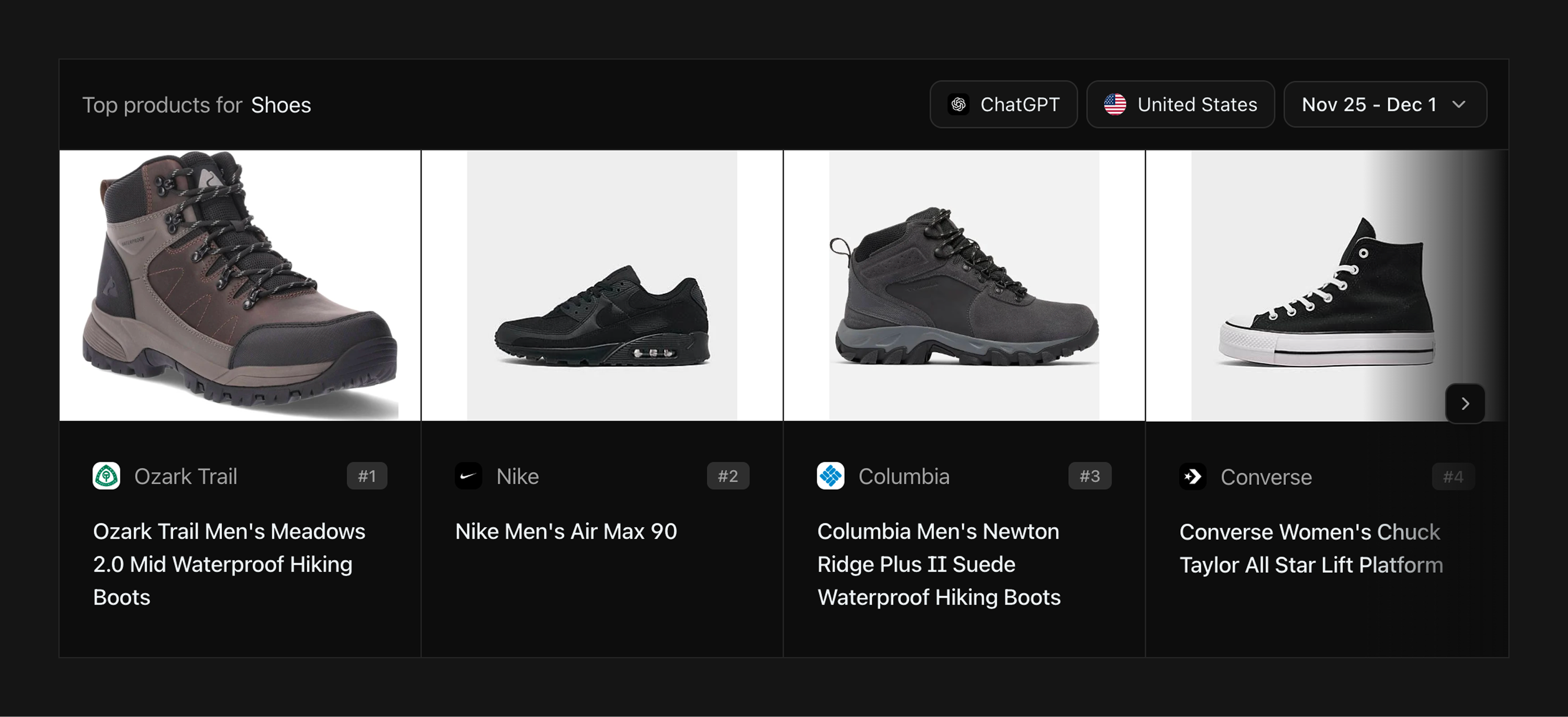

In shoes, the field was more fragmented. Adidas led with a 50.2% visibility score, followed by Walmart (35.6%) and Nike (35.3%). Unlike other categories, brand affinity and specific product strengths created a more competitive landscape within AI recommendations.

What drives visibility in AI shopping?

Across all categories, visibility wasn't just about brand awareness. The most common factors behind high rankings included:

- Structured product detail pages: PDPs with FAQs, deal messaging, and use-case descriptions consistently performed better. Content that answers potential customer questions directly, like Garmin's detailed specs and comparisons, gives Answer Engines the material they need to make confident recommendations.

- Price-targeted content: Prompts often included constraints like "under $1000" or "budget version." Brands that addressed these price ranges on-site showed up more frequently in relevant answers.

- Timely Black Friday content: When users asked "Is [brand] running a Black Friday deal?". Answer Engines relied heavily on pre-existing, indexed page content. Brands with early preparation gained a measurable edge.

What’s clear: traditional SEO heuristics no longer exclusively apply. To win in AI Search, content must mirror how people think and ask, not just how they search.

AI is collapsing the funnel

ChatGPT and similar Answer Engines are collapsing the full shopping journey, from discovery to decision, into a single surface. Rather than asking about specific products, users described use cases:

- "What's a good laptop for a college student under $700?"

- "Best skincare gift sets for dry skin?"

- "Good headphones for running with long battery life?"

In response, ChatGPT didn't just list options, it explained them. Brands that appeared most often were those with content tailored to specific problems, scenarios, or user types.

This is a critical insight heading into 2026: AI Shopping is moving from product-forward to problem-forward. If your product is a good fit for a user's scenario, and you've created content to prove it, AI Search is more likely to surface you.

What retailers should do next

As AI Search integrates native shopping experiences like ChatGPT's Instant Checkout or Target's GPT plugin, visibility will translate more directly into conversions. To prepare for the next cycle:

- Model the full question landscape: What are the most common use cases where your product is a relevant answer? Tools like Prompt Volumes can help identify them.

- Track your AI footprint: Use Answer Engine Insights to measure your brand's visibility across engines and compare it to competitors. Boost your product visibility with Shopping.

- Map content to intent: Use Actions to create PDPs, FAQs, and guides that speak to real questions users ask. Don't just optimize for keywords, optimize for answers.

Final takeaway

AI Search is reshaping consumer behavior. Brands that prioritize structured content over traditional ads will win in 2026.

Explore the Profound Index to navigate category-specific insights updated weekly, and book a demo to see how we can help your brand lead in the age of AI Shopping this holiday season.